Alt Proteins may be at or close to “Peak Pain”: Issue #32

Portrait of a sector rebound in graphs

by Mark Langley

“The farther backward you can look, the farther forward you are likely to see.” —Winston S. Churchill

The 2-Minute Summary

Here’s a quick overview of events driving the turmoil in the plant-based sector:

Media mentions from 2019-2020 start the hype cycle in plant-based foods.

W.H.O. labels Covid-19 a pandemic.

Economic slowdown worries tied to Covid-19 lead to looser economic and fiscal constraints.

Valuations climb and the sector becomes hyper-competitive.

Product disappointments and fewer media mentions lead to stalling of plant-based meat growth.

Inflation leads central banks and governments to tighten monetary and fiscal policies.

Private capital becomes unavailable to many startups, leaving them unable to cross the Valley of Death.

The dynamics of innovative markets are similar from market to market, but Covid-19’s impact and government responses accentuated those dynamics throughout 2019-2023.

We may be at or near “peak pain.” The bad news is “priced in,” plant-based food innovation continues (minus some of the euphoric noise), interest rate increases may be coming to an end in 2024, and the transition to a better food system is still in its early stages.

Plant-based food innovation must continue if we are to mitigate climate change and biodiversity loss.

The companies and products that have survived have weathered a perfect storm.

The 10-Minute Read

To put alt protein’s recent months in perspective, it’s helpful to review where the sector has been.

The Hype Cycle Begins

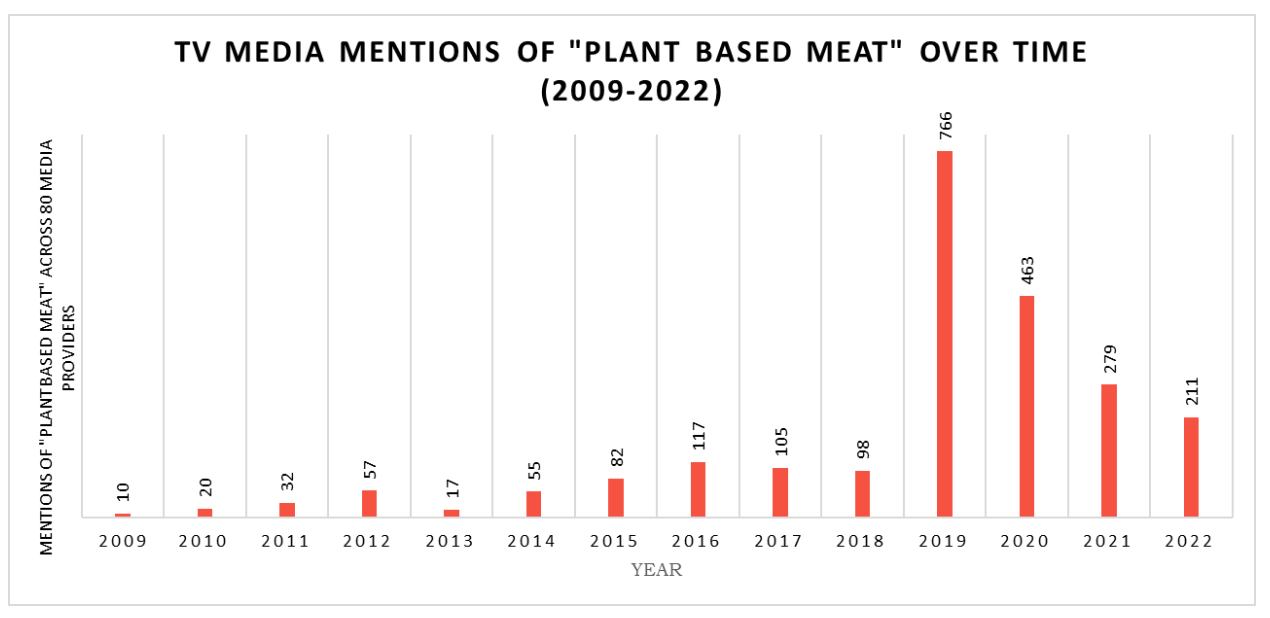

Burger King rolled out the Impossible Whopper and Beyond Meat launched its IPO in 2019–20, spiking a media sensation for “plant based meat” with almost eight times the mentions in 2019 over the prior year, propelling the hype around alt proteins:

Covid-19

The disease that started the troubling dynamics in alt proteins was, quite literally, a pandemic. On March 11, 2020, the World Health Organization (WHO) declared Covid-19 a global pandemic.

Liquidity Makes Markets

Fearing a Covid-19-related recession (or worse), central banks moved quickly to increase liquidity. From the start of January 2020 to July 2023, the US Fed increased the assets on its balance sheet from $4.1 trillion to $8.2 trillion.1

This monetary expansion was executed in parallel with fiscal policies that were put in place to further support the economy. Combined, these actions increased funding to VCs and from VCs to startups as investors moved to investments with different risk-return profiles.

People Bought Goods, Not Services

With Covid-19 lockdowns in effect, restaurants and travel were hit hardest, leaving people with unspent cash, time to spare, and high expectations from the onrush of free media surrounding the still novel plant-based foods.

Products Disappointed, Sales Fell, and Plant-Based was Declared “a Fad” or Even “Dead”

According to GFI, using SPINS data, from 2021 to 2022, U.S. plant-based meat dollar sales were virtually flat, while unit sales declined 8%. Alternative meat sales in U.S. retail locations have fallen by 19.8% year-over-year for the 5-week period ending July 2, according to data from Circana.2 As we see from the figures below, plant-based meat sales have been shadowing the drop in media coverage.

Michal Klar of Better Bite Ventures and Albrecht Wolfmeyer of ProVeg Incubator point to stronger performance from Germany, with 17% growth in volume and a +22% in value over 2020, according to production numbers from the Federal Statistical Office.

As Beyond Meat’s, Oatly’s, and others’ valuations flipped from overhyped ethereal levels to more recognizable food company valuations and with expectations running ahead of actual products, the alt protein sector headed for the trough of disillusionment depicted in the Gartner Hype Cycle.

Inflation Spiked

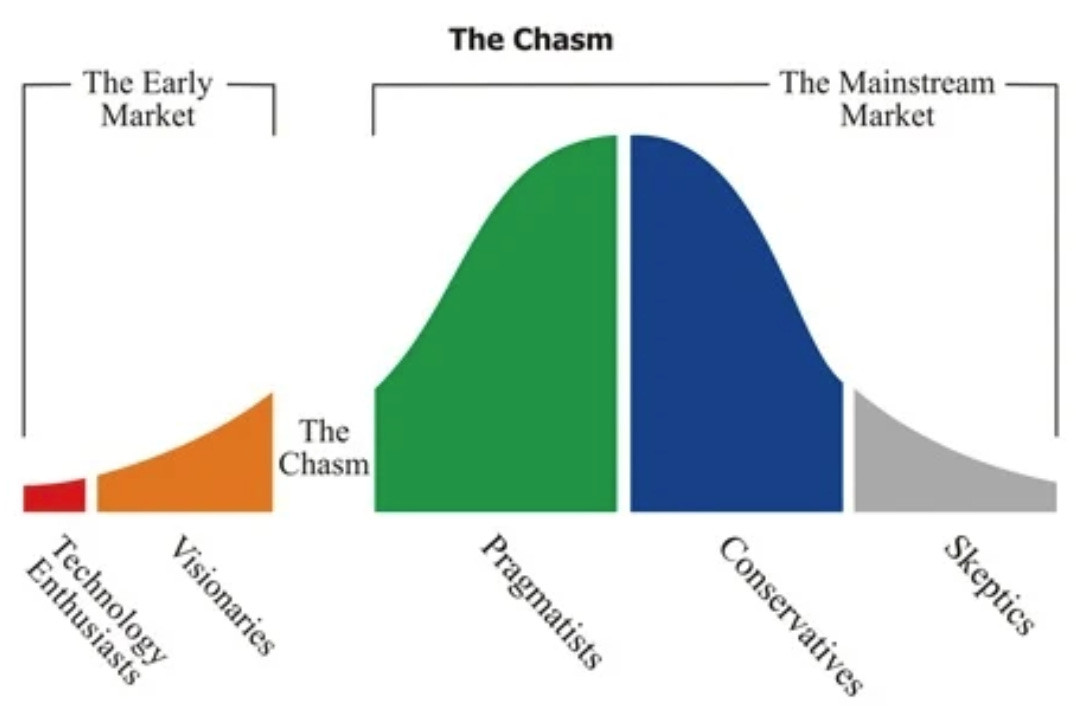

With rising inflation, the US Fed slowed its QE and began raising rates, starting in mid-March, 2022. This left companies facing Geoffrey Moore’s Chasm with little liquidity.

Readily available capital, low start-up costs, and the promise of a better world through alt proteins over-saturated even niche opportunities, leaving many unable to cross the chasm, even with robust products that might have otherwise made the leap.

With market saturation of concept products, a collapsing hype cycle, capricious media, and rising interest rates, the downturn in alt proteins began in earnest in late February/early March of 2022.

Most pre-A round companies raise for an 18-month runway. Most Series A to B companies raise for 10-18 months. Ten to eighteen months from March 2022—when financing opportunities began to vanish—brings us to January through September 2023.

With Another Interest Rate Hike and More Bad News, It May Get Worse Before It Gets Better

Low-risk, high-return fixed-income investments displace venture capital, and increases in interest rates are negative drivers of both company performance (e.g., loss of key employees, inability to obtain financing), and valuation (via lower expected future free cash flows and a higher discount rate used to value those cash flows). US Federal Reserve officials said that the FOMC will need to raise interest rates once more this year to bring inflation back to the central bank’s goal.

Some marquee plant-based companies and brands are also facing funding and operational challenges. With the faltering of some leading firms, we may see more corporate carcasses in the valley of death, which may lead to further claims that plant-based foods are a fad.

While the Timing and the Magnitude were Unpredictable, the Fallout was Not

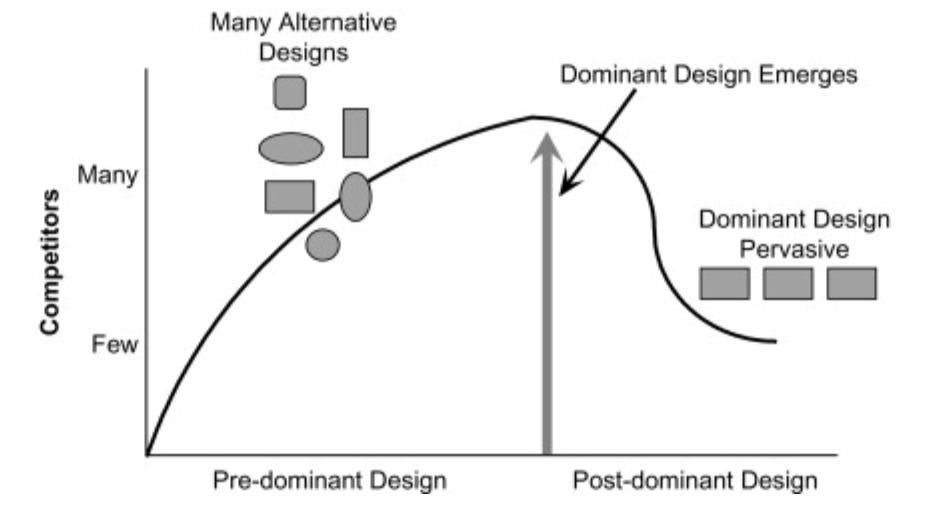

While it is relatively easy to enter a market, it can be quite challenging to break through. From James Utterback’s Mastering the Dynamics of Innovation, it is clear that the rate of competitors in an innovative market ramps quickly until a dominant design emerges. Those who can’t compete leave the market.

As Prof. Utterback reminds students, “Next time someone tells you, ‘This time is different,’, don’t you believe them.” It happens in every industry.

Once the dominant products emerge, the competitive focus shifts to the process.

As a recap, here are some of the inflection point drivers in plant-based meat:

As Discouraging as This All Sounds, We See Opportunities When We Look Beyond the Headlines

We believe that we are at or near “peak pain” in the sector.

Inflation has subsided dramatically; an end to interest rate hikes and to quantitative tightening should follow (after perhaps one more rate bump in 2023); on May 5, 2023, WHO declared “with great hope” an end to Covid-19 as a public health emergency; the hype cycle is in the trough of disillusionment; both publicly-traded and privately-held alt protein valuations have retreated to more realistic levels; and the chasm and the valley of death have claimed weaker companies and chased away bandwagon-hoppers who crowded out smarter money. The companies and products that have survived have weathered a perfect storm, and the food scientists have continued making progress toward organoleptic equivalence and price parity, despite it all.

As Carlota Perez informs us, grand technological revolutions take approximately 50 years to move from their “big bang” to market saturation. Technological revolutions take time, and the alt protein industry is still in the early days of Phase 2.

Is the sector at or near the bottom? Ceteris paribus, we think so.3 This is the time for consolidation, and to reassess products, opportunities, and valuations. The transition to Phase 3 for the steel industry (from cast and wrought iron) shows what could be in store.

We’re confident that the sector will rebound. In fact, it must.

The global food system emits more than a third of global greenhouse gasses, contributes to 80% of tropical deforestation, and is a primary driver of soil degradation, desertification, water scarcity, and biodiversity decline.

If we are to forestall a future of pervasive food insecurity, biodiversity loss, storms, floods, fires, and droughts, and consequent water wars, mass migrations, and health calamities, then we need to accelerate the transformation to alt proteins for a more just and sensible food system.

The US Federal Reserve cut its target for the federal funds rate 1.5% in March, lowering the rate to 0–0.25%. The Fed also focused on quantitative easing (QE) with massive purchases of Treasury securities and government-guaranteed mortgage-backed securities to increase the flow of credit to the broader economy. It lowered the rate it charged banks for loans from its discount window, relaxed regulatory requirements to encourage banks to increase lending, began lending directly to corporations by buying new bonds and providing loans, bought commercial paper, and started a Paycheck Protection Program (PPP) for businesses.

Circana’s (formerly, Information Resources, Inc. (IRI) and The NPD Group) point of sale data covers multi-outlet channels (grocery, mass, supercenter and club), but excludes natural channel retailers such as Whole Foods and convenience stores.

One could argue that there is no “normal” anymore. There are at least four drivers of food-related instability: the climate crisis, resource shortages, the biodiversity crisis, and economic shocks (particularly, in China, the world’s second-largest economy by nominal GDP).